CAR Market Minute August 8th, 2022 — Last week we celebrated the recovery of all jobs lost in 2020, and the unemployment rate dipped back to the lowest level since 1969. The latest jobs report showed that the labor market remains strong despite other signs of economic weakness. This unexpected surge in hiring, however, also put further pressure on the Fed to act aggressively in its fight against inflation. Aggressive interest rate hikes from the Fed are a potential threat to the economy at this point of the business cycle and could trigger further slowdown in economic activity in the upcoming quarters. With interest rates expected to rise while home prices remaining elevated, the housing market will continue to face growing affordability challenges in the near term.

California housing market continues to show signs of a slowdown

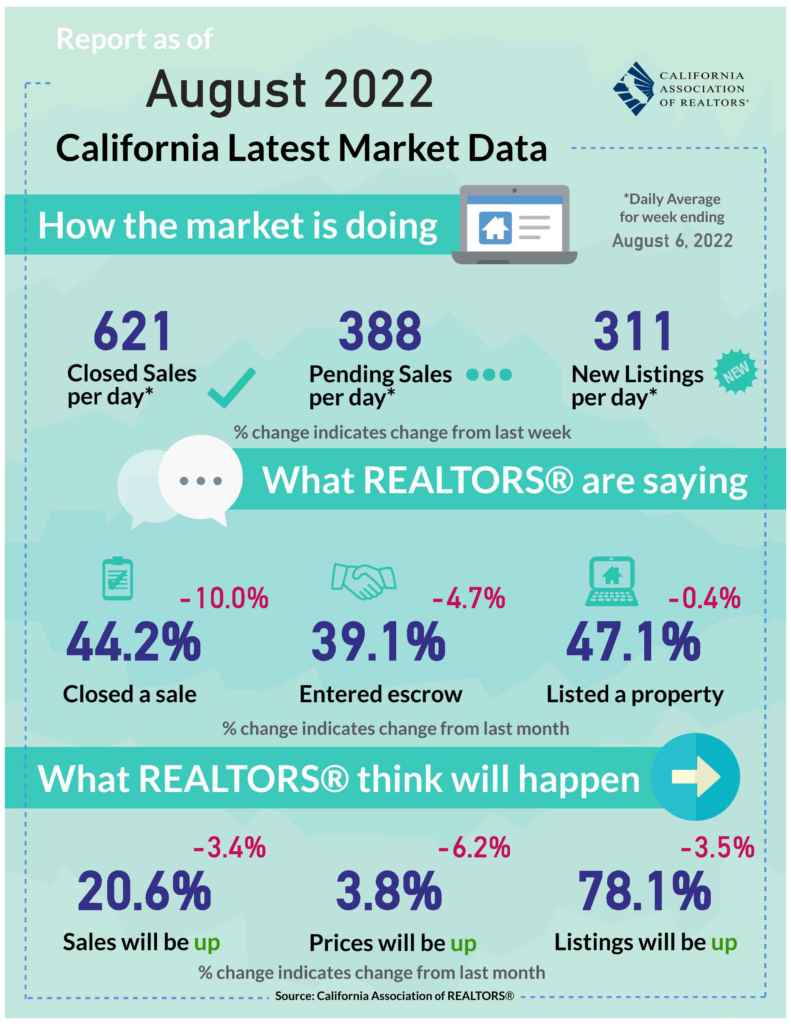

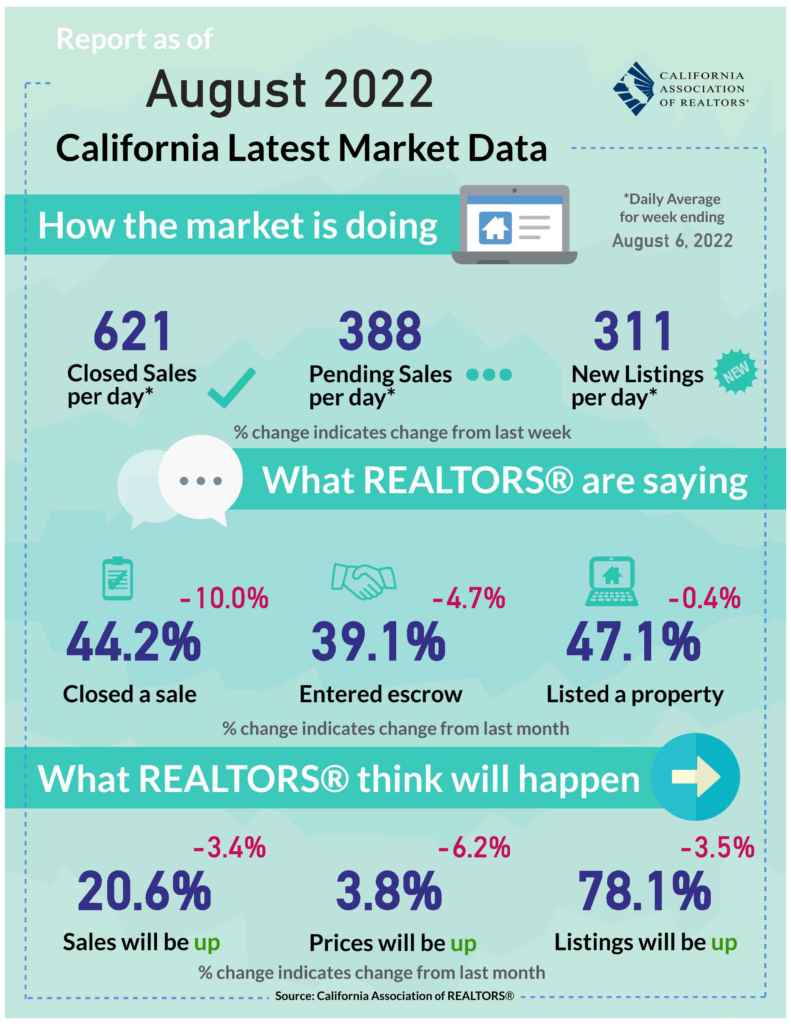

The latest daily-average weekly-sales number for week ending August 6 fell to the lowest this year and neared the lowest number recorded during the pandemic induced shutdown in 2020. Consistent with a softening single-digit price growth and an increasing share of active listings with price reduction reaching 41.4%, nearly 8/10 members of the California Association of REALTORS® (C.A.R.) indicated in the latest survey that buyers were indeed expecting lower prices. This combined with recent dip in mortgage rates will hopefully boost sales activity again in the coming weeks.

Mortgage rates dip below 5% but will likely bounce back

While mortgage rates remained volatile due to the tug of war between decades-high inflation and the possibility of a recession, the 30-year fixed-rate mortgage (FRM) dipped below 5% for the first time in nearly 4 months averaging 4.99% for the week ending August 4. The week prior, the 30-year FRM averaged 5.30% and the same week of last year it averaged 2.77%. Supply constraints and a tight labor market will likely push rates back up, especially since the Fed is determined to bring inflation down even at a cost of a slight economic downturn.

Strong jobs report cast doubt on the possibility of the recession

Nonfarm payrolls rose 528,000 in July, pushing the unemployment rate down to 3.5%. The unemployment rate is now back to its pre-pandemic level and tied for the lowest since 1969. Meanwhile, wage growth surged higher, as average hourly earnings jumped 0.5% from the prior month and 5.2% from the same time last year. The increase could have an effect on Fed’s monetary policy tightening decision as strong wage growth adds fuel to an inflation picture that already has consumer prices rising at their fastest pace since early 1980s.

More prospective buyers are actively searching for a home

The share of prospective buyers who were actively engaged in the process to buy a home rose to 49% in the second quarter 2022, after declining for 3 consecutive quarters. Fewer competitions and cooling off in demand for housing due to affordability constraints, led to a significant growth in housing inventory, which might have encouraged those who remained in the market to be more aggressive in their home search. An increasing number of homes with a price reduction might also have provided buyers an incentive to get back into the market.

Homeownership rate tickles up despite affordability challenges

The Census Bureau’s Housing Vacancy Survey (CPS/HVS) reported the U.S. homeownership rate at 65.8% in the second quarter of 2022, a slight increase from last quarter’s 65.4%. Buyers were feeling the budget pressure as rates continued to rise, but creative financing and the strong desire to own helped many buyers pushed through in the second quarter anyway. The national rental vacancy rate slipped to 5.6%, while the homeowner vacancy rate stayed at 0.8%. Both rental and homeowner vacancy rates were hovering near historical lows, reflecting tight housing market conditions.

Do you have questions? Be sure to contact me to discuss this week’s report.