Getting Back to Normal in the Desert. Payrolls jumped a stunning 467,000 jobs in January. Wow!!! That is a huge number folks. Employment levels are getting back to pre-pandemic numbers and that means normalizing rates. The word on the street is a .5 point jump by the FED in March. Know that our industry has already assumed that, with proof of the 10-year T-Bill at 1.92 this week. That is a monster jump again. Rates are beginning to normalize and our prediction by mid-year is rates commonly starting with a 4 handle in front of them. Even the head of the European Central Bank chimed in yesterday stating that they too are seeing inflation as their main concern. Christine Lagarde’s comments suggest an increase soon to European rates as well.

What does this all mean?

Interest rates in January of 2019 were just below 5%. A 100% complete, normal and good rate when looking at history. What we are seeing with rates now in the high 3’s are quite a few buyers pushing back a bit, in overpaying for a home. When a borrower is getting a mortgage rate in the 2’s, they might analyze and say, “hey, I’ll pay over price because my payment for the next 30 years is dirt cheap”. Real estate always goes up over the long term, so someone buying to hold isn’t worried about a small mark up over asking price in that case. Now as we are up over 1% with rates in less then a month, many of our buyers are saying “hold on, I have to pay 10% over ask and my rate is up over 1% from when we started? I think I’ll take a pass for now and let this all settle down”. You will start to see that push back and sellers will deal with this reality in the months to come. The 9 offers on a home with 8 of them over asking are going to start to see a reality shift. You will probably try to tell me about low inventory, but as rates rise, demand lowers and inventory grows. This is natural economics folks. Nothing fancy. Watch how it plays out. You can save this email and refer to it this coming August and let me know how I did?

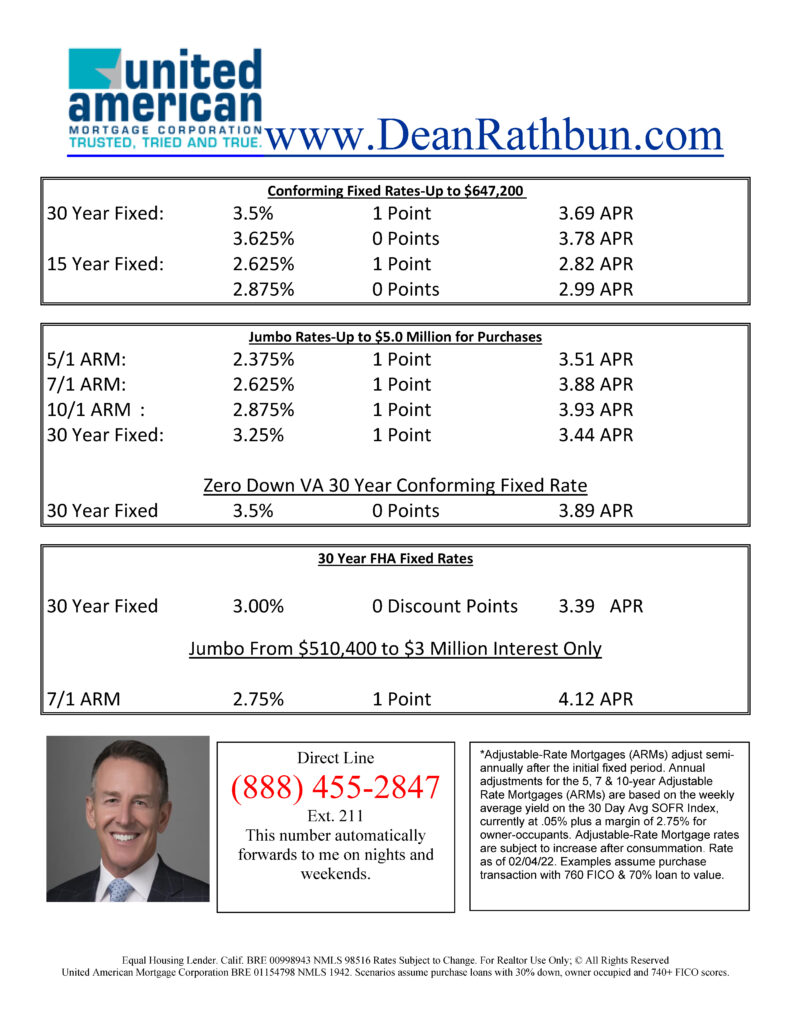

Jumbo Loans

In another note, one of our jumbo investors actually CUT BACK their loan to values and will now lend less on jumbo mortgages requiring a larger down payment. Their view of the market is it can’t go up forever so they are hedging a better balance to the market. This is only one investor out of 48. Maybe their wrong, but let’s see how that plays out over time if others follow.

Did you know that a Veteran can have a non-veteran co-signor on a house/loan they are buying to live in? Yes it can happen. The entitlement of the Veteran can be used at full capacity with their guarantee. That means you cannot do a low down payment for financing. When a non-veteran co-signs, there is a complicated formula we use for a maximum loan to value. I am a certified Military Housing Specialist and I can help you in these situations.

Often I find myself extremely impatient with people working through physical setbacks. An aching back, a pulled hamstring. These are just parting of living and being active. But this week I found myself on a 10 scale of pain with a shoulder tear. It truly humbled me and I was reminded how important health and being pain free is. But more than that, it reminded me of patience in healing and in life. One of our true visionaries today Elon Musk stated “patience is a virtue, and I’m learning patience. It’s a tough lesson”. I feel his frustration.

Written by Team Member, Dean Rathbun