Let’s Stop the Madness!! Last week, I started getting asked about a “penalty” that high FICO borrowers would have to pay on behalf of lower FICO borrowers. Initially, I was a little confused as to why all of the sudden interest in this topic from friends and family who typically have little interest in the mortgage industry aside from the occasional, “How’s business?” discussion.

Well, a quick Google search revealed that many media outlets were starting to report these pricing changes as coming soon! So, a headline like this from USA Today on April 23,2023, “Mortgage fees are changing for homebuyers next month. Here’s what you should know” will certainly pique certain readers interest, but unfortunately it’s wrong from a borrower’s perspective.

This was actually announced earlier this year.

These Loan Level Pricing Adjustment (LLPA) changes were actually announced back in January as I mentioned in my first edition of TMI. What the media is picking up on now is this May 1, 2023 delivery date that was referenced in the original announcement.

In order to meet this delivery date, lenders have already incorporated these changes into their rate sheets many weeks ago, if not longer, depending on how quickly they are able to deliver a mortgage pool to the agencies. If the LLPAs are not included in their pricing to the consumers, they run the risk of having a loan with some serious margin loss.

So if you’re starting to get calls from borrowers to lock their loans, to avoid this, it’s too late.

The other headlines I started seeing centered on how homebuyers with higher credit scores would somehow get stuck with higher mortgage rates. What?

On April 21, 2023 published a story with this headline: “The admin’s new rule will punish people with high credit scores.” That’s certainly going to get some people’s blood boiling.

So, what does all of this actually mean?

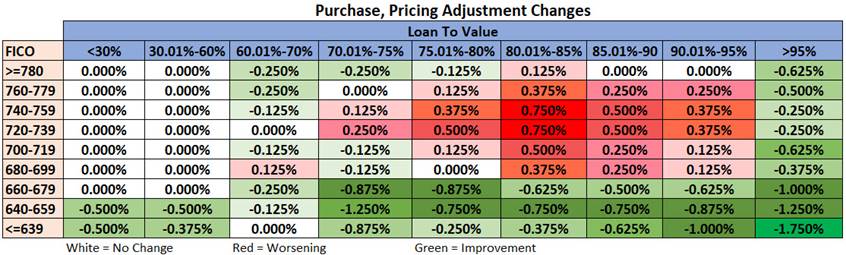

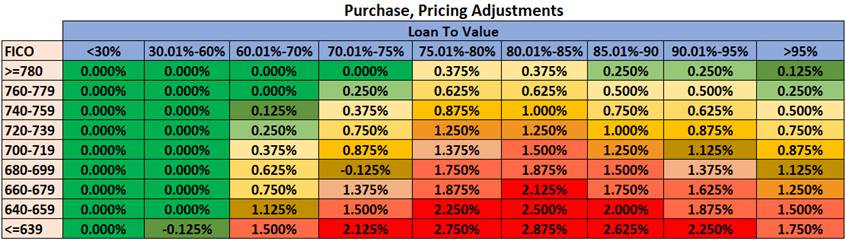

The LLPA changes do improve costs for those with lower credit scores and for those in highest LTV column. Additionally, there are increases with some costs for those with higher credit scores depending on the FICO and LTV combination. However, the focus of many of these articles is almost exclusively on the pricing adjustment changes (the first chart below) without looking at the actual LLPAs being applied when determining pricing (second chart below).

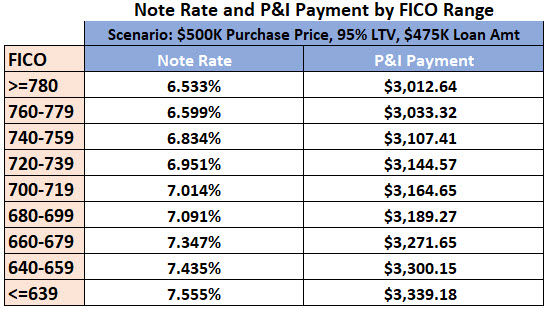

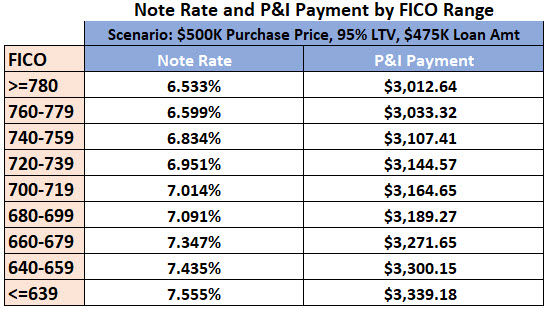

So let’s take a look at how these translate in to note rates and payments. What this chart shows is the interest rate difference between a borrowers with various FICO ranges. In the most extreme example, a borrower with a 780 score and one with a 639 credit score can be separated by 1% or more in the interest rate, meaning the 639 borrower will pay more, much more.

The craziest thing of all is these stories have some people asking if they should start missing payments in an effort to lower their score to get a better rate. The answer is an unequivocal NO!

So, let’s stop the madness and make sure if you run across someone who is thinking of tanking their score to get a better rate, share these charts with them!

So why did FHFA do this?

The FHFA, the regulator who supervises Fannie Mae and Freddie Mac, whose “mission” is to promote affordable homeownership, made these changes as a tool to provide more affordable housing to lower credit score borrowers by reducing the spread between those with better credit scores and those with lower credit scores.

Is this the best approach? Hard to say. Does it feel like an overreach? Maybe. But, I’d say that creating more affordable housing opportunities for more families is good for the mortgage industry and the country, in general. Homeownership is the primary vehicle for creating generational wealth and that would be a really good thing.

Article provided by Dean Rathbun, United American Mortgage

NMLS #98516 l CA DRE #00998943

888-455-2847 Toll Free