Weekly California’s Market Minute – July 11, 2022 – Strong economic data on jobs reinforces the Fed’s view that inflation will persist, but recent turbulence in consumer sentiment and overall spending data show that the macroeconomy still has many challenges ahead. Active listings continue to rise and buyers are facing a rising number of homes available for sale and a market that isn’t as “red-hot.” And, unlike last year, they may find sellers more motivated to sell.

Jobs Data Remains Strong: Despite rising economic uncertainty and borrowing costs, employers continued to hire at a robust clip in June with 372,000 new jobs created. As the economy continues to recover from the pandemic restaurant and hotel jobs continue to show solid progress. However, professional and healthcare jobs also expanded noticeably. New construction jobs were also in the mix last month, but that was due to an increase in nonresidential construction jobs—residential construction jobs actually fell slightly last month.

Rates Continue to Ebb Amidst Uncertainty: Despite recently-released minutes from the Federal Reserve’s latest meeting showing a strong commitment to fighting inflation that remains well above their target, mortgage rates fell for the second straight week to 5.30% according to the latest Freddie Mac survey. That is down from 5.70% the previous week, which was down from 5.81% the week before that. That still marks a significant rise from the sub-3% rate we began 2022 with but is welcome news to buyers who may be entering escrow and locking rates for a closing in the near future.

Inventory Rising to Pre-Pandemic Levels: After several years of extremely depressed inventory available for sale, buyers are seeing the number of options available on the market return to pre-pandemic levels. Last week, there were nearly 46,000 homes listed on various MLSs across the state. That is well above 2021 levels and is approaching the 2020 peak reached before the effects of the pandemic began to erode supplies. Encouragingly, listings of homes priced below $600,000 have started to rise as well, with twice as many homes between $400,000 and $600,000 for sale last week than at the beginning of the year.

Mortgage Applications Remain Below Pre-Pandemic Level: Despite the recent reprieve in mortgage rates, mortgage applications continue to fall behind the pre-pandemic pace of 2018 and 2019. Mortgage applications have been falling from 2021 levels for some time, but the number since April have now been consistently below the pre-covid level for the first time since the lockdown began in early 2020. This suggests that buyer demand, which has already begun to weigh on pending and closed transactions, will likely further constrain home sales as we enter the second half of the year.

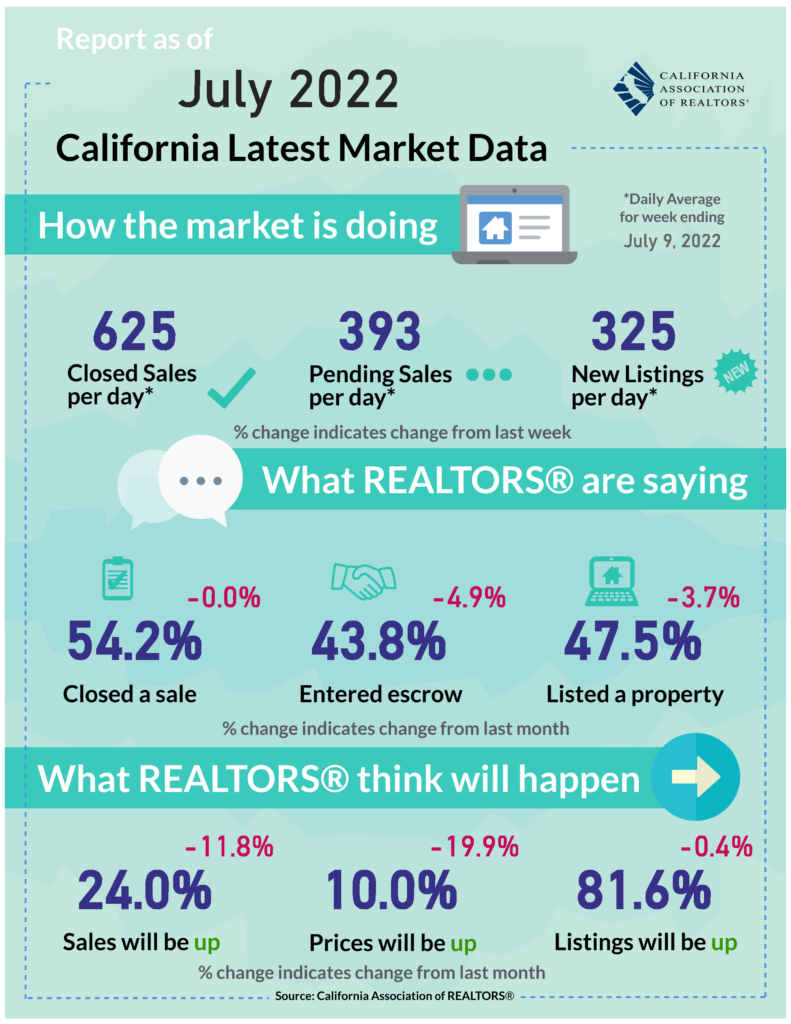

Market Continues to Normalize As Rates Rise: As buyer demand has eased in the face of higher interest rates, we see ongoing signs that the market is rebalancing from the frenzied pace of the last two years. With both fewer buyers filling out mortgage applications and a rising number of available listings, the imbalance between supply and demand has started to ease slightly. Active listings are staying on the market longer, more sellers have begun to reduce the price on their listings, and on the transactions that have closed recently, fewer buyers were paying over list price. The market remains competitive relative to the pre-pandemic norm, but we should expect further moderation as the imbalance normalizes further.

Modest Recession Likely in 2023: The recent data on jobs is encouraging that we are not poised for a major financial crisis like we experienced back in 2008. However, other indicators show that the risks of recession in 2023 have risen sharply. Consumer confidence fell to a decade-low level last month and has been trending down ever since interest rates and gas prices began to rise. In addition, recently revised economic numbers on income and spending show that consumers are no longer able to keep pace with inflation as real spending has begun to dip negative. Given that consumers have driven almost all of the recent economic growth we have enjoyed, financial market volatility, higher borrowing costs, and rising prices are mean we should expect additional pullbacks in spending. As such, economic growth may dip negative later this year or early next year in what is expected to be a mild and short-lived recession.

July 11th, 2022 – Weekly Market Minute